Context

-

The government is reportedly considering a regulatory framework for special purpose acquisition companies (SPACs) to lay the ground for the possible listing of Indian companies through this route in the future.

About Special Purpose Acquisition Companies (SPACs)

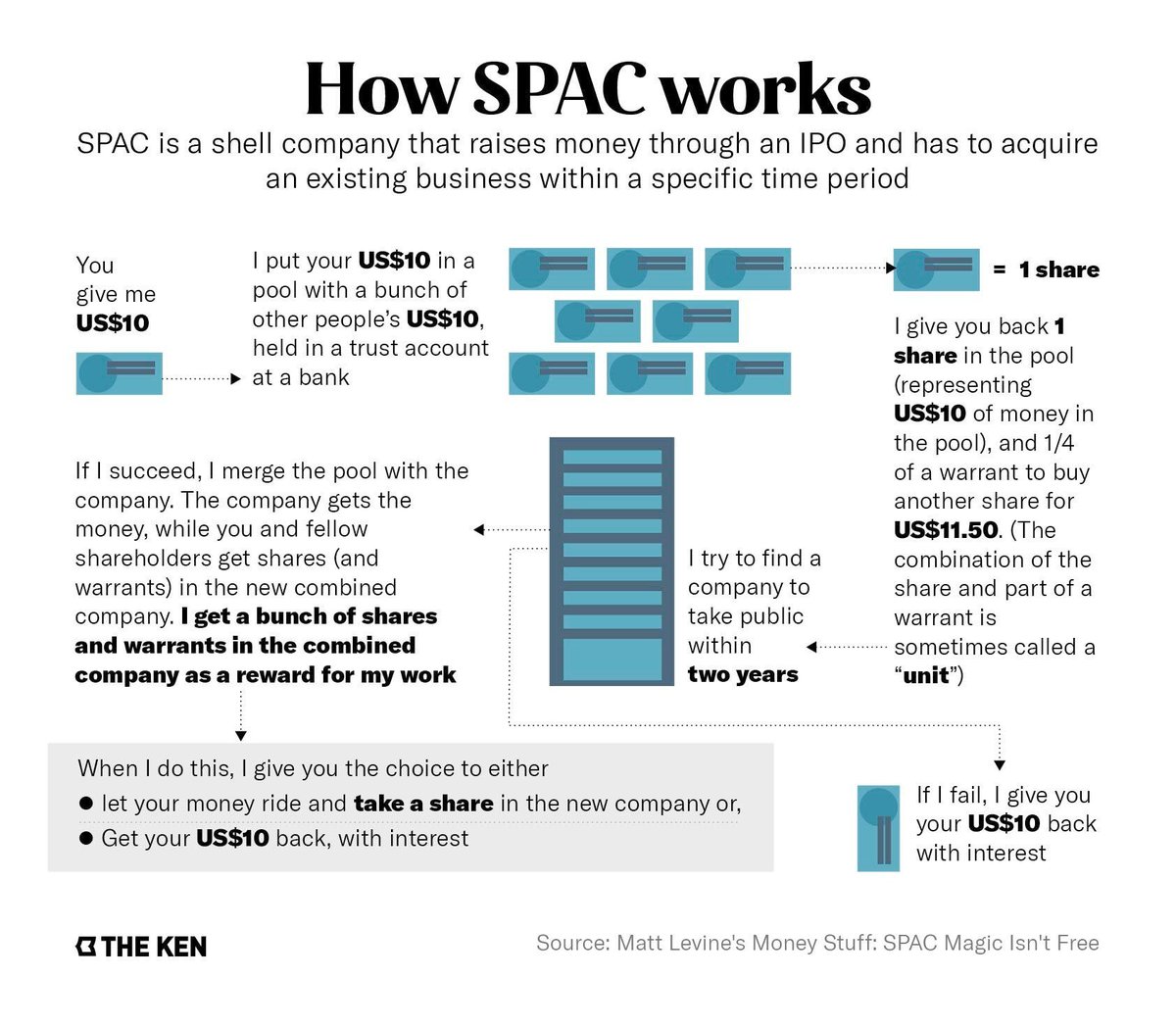

- An SPAC, or a blank-cheque company, is an entity specifically set up with the objective of acquiring a firm in a particular sector.

- An SPAC aims to raise money in an initial public offering (IPO) without any operations or revenues.

- The money that is raised from the public is kept in an escrow account, which can be accessed while making the acquisition.

- If the acquisition is not made within two years of the IPO, the SPAC is delisted and the money is returned to the investors.

- According to the American regulator, certain market participants believe that, through an SPAC transaction, a private company can become a publicly-traded company “with more certainty as to pricing and control over deal terms as compared to traditional IPOs”.

- While SPACs are essentially shell companies, a key factor that makes them attractive to investors are the people who sponsor them.

Where India stands?

- According to data sourced from SPAC Insider, a portal that maintains a record of SPAC deals, of the 1,145 IPOs by blank-cheque companies since 2009, 248 happened in 2020, 613 in 2021, and 58 in 2022 so far.

- Early last year, renewable energy producer ReNew Power announced an agreement to merge with RMG Acquisition Corp II, a blank-cheque company, in what became the first involving an Indian company during the latest boom in SPAC deals.

Risk factors around SPACs

- The boom in investor firms going for SPACs and then looking for target companies have tilted the scales in favour of investee firms. This has the potential, theoretically, to limit returns for retail investors post-merger.

- Also, even as the SPACs are mandated to return money to their investors in the event no merger is made within two years, the fineprint of several SPAC prospectuses shows that certain clauses could potentially prevent investors from getting their monies back. Historically, though, this has not happened yet.

- However, celebrity involvement in a SPAC does not mean that the investment in a particular SPAC or SPACs generally is appropriate for all investors…It is never a good idea to invest in a SPAC just because someone famous sponsors or invests in it or says it is a good investment.

Reference:

Visit Abhiyan PEDIA (One of the Most Followed / Recommended) for UPSC Revisions: Click Here

IAS Abhiyan is now on Telegram: Click on the Below link to Join our Channels to stay Updated

IAS Abhiyan Official: Click Here to Join

For UPSC Mains Value Edition (Facts, Quotes, Best Practices, Case Studies): Click Here to Join